While student loans may be a common way to pay for a college degree, they are not the only option! Today we’re exploring 10 ways you can avoid student debt.

anchor

1. Search and apply for scholarships

Scholarships are financial aid awards given to students who meet specific criteria determined by the scholarship-giver. Often merit or needs-based, the best part about scholarships is they do not have to be repaid.

When looking for scholarships, cast a wide net. You’d be surprised at the types of scholarships you’ll be able to find. Are you part of any clubs or organizations that offer scholarships to their members? Do you have any unusual hobbies or talents? Have you participated in sports or service projects?

If you’re still having a hard time figuring out where to begin, a good place to start is by asking your school counselor or by working with your school’s financial aid officer. You can also consider searching for scholarships online.

Helpful websites to search for scholarships on:

- Scholarships.com

- Fastweb.com

- CollegeBoard.org

- FinAid.org

anchor

2. See if you qualify for grants

Unlike student loans, grants generally don’t have to be repaid. Grants can come from your state government, the federal government, your college/trade school, or a private/nonprofit organization. By doing a little research and applying for the grants you qualify for, you could potentially lower the total amount from student loans that you need to borrow or eliminate the need to borrow.

anchor

3. Work with your school’s financial aid office

Did you know that most college or career schools have a financial aid office whose sole purpose is to help students figure out ways to finance their education?

You can work with the financial aid office to see if the school you’re attending offers grants, scholarships to students who hold on-campus jobs, or if they can set up a tuition payment plan for you. They can also help you apply for grants, scholarships, and other types of financial aid.

anchor

4. Look into student loan forgiveness programs

Are you interested in a public service career? We may have good news for you!

Graduates who work within the public sector with government organizations, non-profits, law enforcement, teaching, or military service may qualify to have their student loans forgiven. Yes, you read that correctly. You could qualify to have your student loans forgiven.

Keep in mind: there is a list of specific requirements you need to meet in order to have your student loans forgiven. Often you will be required to make payments on your student loans over a set amount of time, verify you have worked within the public service sector for a specific number of years (and/or are currently still working in that field), and there may be more specific requirements depending on your career.

Long story short: while we don’t recommend relying on student loan forgiveness as a long or short-term strategy for taking out student loans, it may be worth looking into. While it’s difficult to qualify for complete student loan forgiveness, you may be able to qualify for partial student loan forgiveness depending on your career.

anchor

5. Take general education courses at a junior college or community college

Most college degrees require you to take general education (gen ed) courses—required curriculum that’s foundational knowledge to your area of study. This includes courses like science, math, English, and history.

Compared to what some universities charge per credit hour, gen ed courses can be a fraction of the cost. That’s why some students complete their gen ed courses at a community or junior college then transfer their credits. Depending on your field of study, you might even be able to complete your associate degree and then transfer to a university to complete your bachelor’s degree.

If you choose this route, make sure you work with your college advisor to ensure the credits you are taking will transfer to your college of choice.

anchor

6. Consider staying in-state

If your dream college won’t accept the gen ed credits you’d take at a community or junior college, take a look at completing those gen ed credits at an in-state public school. With the help of in-state tuition, you could literally save thousands of dollars a year when compared to a private college.

Or, if you don’t have a dream college, consider attending an in-state public school for your degree. Not only will you save money on tuition, you can dramatically reduce the amount of money you’d spend to travel home over the holidays.

anchor

7. Reduce your living expenses

A large portion of your college expenses will be your living expenses. You can find ways to reduce these expenses upfront, which can help you avoid taking out student loans. For example:

Reduce your rent

- Instead of living on your own, consider having roommates. This doesn’t necessarily mean you have to share your room either. You can still save thousands of dollars per year if you have your own room.

- Consider living off-campus. While it may be convenient to live on-campus (hello short commute!) rent can often be significantly higher than off-campus options. Look for places that are close to public transportation, or are within walking distance from campus.

- If you’re able to, consider living at home or with a relative or family friend. Even if it’s a short commute to campus, you might still be able to significantly reduce your living expenses this way.

Reduce your academic expenses

- Rent your textbooks, instead of buying them. For a fraction of the price—especially for the really expensive ones—you can rent a textbook for a semester.

- Textbooks are full of information that may be required for a specific class, but what do you do with them after the course ends? Consider selling them! You can recoup some of the money you paid for it, and, there’s always the internet to help refresh your memory after graduation.

- You don’t have to buy new textbooks. If you’re able to find used textbooks at the campus bookstore, or online, go for it! You might also be able to buy textbooks from friends who completed the course last semester.

Leave your car at home

- Sometimes cars are necessary when you’re at college, and sometimes you can do just fine without one! See if it is feasible for you to not have a car while attending college. This could save you lots of money in the long run—gas, insurance, parking, maintenance, and more!

anchor

8. Work part time during college, and full time during the summer

While it can be tempting to complete your degree as quickly as possible, if you’re able to avoid taking out student loans by reducing the number of credits you take each semester so you have enough time to work part/full time, it may be worth considering. You can even take a semester off to work full time—a popular option for college students during the summer.

anchor

9. Start saving early

If you have a few years before you start college, or are thinking about going back to get that graduate degree, the earlier you begin saving the better. There are lots of options for you when it comes to picking out what type of account to save your money in. Take your time in selecting which account makes the most sense for you to use. Below are two options to help get you started:

529 College Savings Plan

If you have a parent or guardian who is able to help you save for college, consider having them start a 529 plan for you. Or, if you are at least 18 years old, you can open a 529 plan and name yourself as the beneficiary.

- Benefits: There are a few tax advantages to 529s - often these is no federal tax on earnings, and there may be state income tax deductions. While there is no annual contribution limit, there are limits to be mindful of to avoid gift taxes. Depending on the sate you live in, there may not be an age limit for distributions.

- Drawbacks: Contributions must be used for tuition and other school-related expenses - like books, computer programs, supplies and equipment.

Standard Savings Account

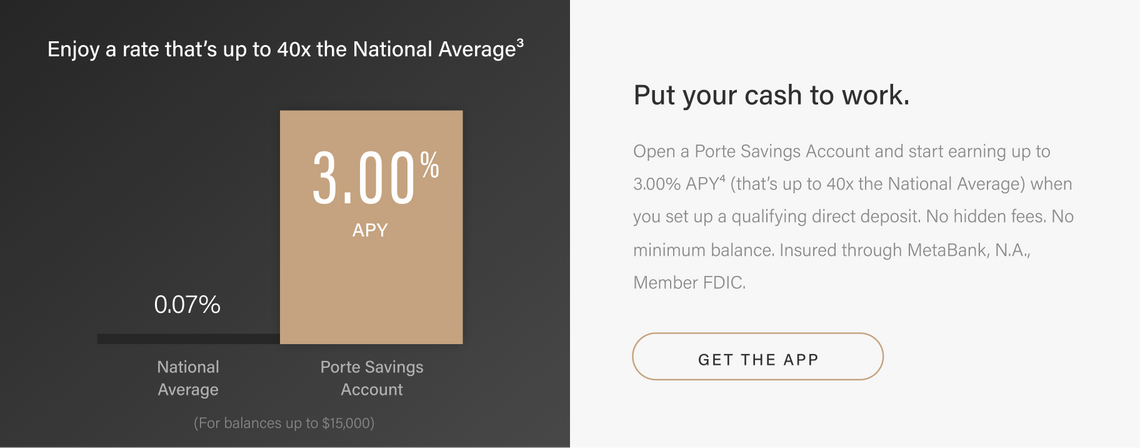

- Benefits: The biggest perk about using a standard savings account is that you aren’t limited on how you can spend your money. These types of accounts are also low-risk when compared to Coverdell ESAs or 529s since they’re federally insured by the FDIC.

- Drawbacks: There typically aren’t any tax advantages, like wat you’d get wit the Coverdell ESA or 529 accounts, for standard savings accounts. And, they don’t always have the best rate of return. You can, however, take advantage of high-yield savings accounts, like the like the optional savings account you can obtain through Porte, and which MetaBank, N.A., provides.⁴.4

These are only a few of the options you have when it comes to the types of savings accounts you can take advantage of while saving for your education. If you’re interested in learning which account works best for you, consider talking with a financial advisor.

anchor

10. Make and keep a budget

When your expenses are high due to tuition, room and board, supplies, and textbooks, and your income may be limited, it’s the best time to make and keep a budget. Luckily for you, there are a lot of tools and resources available to help you create a budget and track your spending.

For example, you can use Porte’s Budget Tracker to make sure your monthly spending is within your budget. Or, you can use Porte’s Budget Calculator, in the blog post below, to create a budget tailored to you.

While at times it may feel impossible to avoid student loans, with some saving, planning, budgeting, and exploring of all of your financing options, you’ll be able to make sure your student loan debt (if you need to take out any) won’t get the best of you after graduation.

Take note: For more information and to see if you qualify for grants or student loan forgiveness visit StudentAid.gov.