You’ve found yourself at the point in your student aid journey where you feel as though you’ve exhausted all of your options. You have applied for every scholarship, grant and federal student loan, but there is still a gap in what you’ve received in financial aid and the price of your school’s tuition. What type of financial aid is left?

Time to talk about private student loans. But, why wait to talk about them until after all other options have been exhausted? Private student loans are not issued by the government, and therefore, the terms, eligibility requirements, and borrower benefits can differ among the various providers. Private student loans are typically issued by banks, credit unions, or other state agencies. Given the potential differences in the terms of the loans across providers, it may require a bit more research on your end to determine which private student loan is the right fit for you based on your personal circumstances.

But fear not. Below we’ve outlined the top 4 things to consider when selecting a private student loan provider.

- Eligibility Requirements

- Interest Rate

- Repayment Options

- Borrower Benefits

While it may take some time to comb through your options, keeping these four things top of mind will help you narrow down your options in no time.

anchor

1. Eligibility Requirements

One of the biggest differentiators between federal student loans and private student loans is the eligibility requirements. Oftentimes, private student loan providers will require that the applicant have a well-established credit history in order to apply for a loan. But, what if you’re a high school graduate with little to no credit history? Are you still able to obtain a private student loan for your college education?

Generally, yes. While many private student loan providers will require an established credit history, if an applicant does not have a sufficient credit history, loan providers will allow the applicant to have a co-signer. A co-signer could be a parent or guardian with a more established credit history who chooses to sign onto the loan with the student.

Why do private loan providers care about an applicant’s or the co-signer’s credit history? Loan providers want to know that the person they are loaning money to is likely to pay them back, and the credit history of the applicant or co-signer can show whether or not someone is capable of paying back loans and borrowings on time and in full.

It’s important to remember that eligibility rules differ depending on the provider. So, while one lender may require sufficient credit history, the next lender may not. Some other eligibility requirements to look out for may include education, age, and citizenship requirements.

anchor

2. Interest Rate

Now that you’ve determined you’re eligible for certain private loans, it’s time to compare interest rates. First, consider if the interest rate offered is fixed or variable. Meaning, is the interest rate the same for the entire life of the loan, or does it change with fluctuations in the market over time? Federal student loans by their nature have a fixed rate, whereas private student loans can have fixed or variable rates, depending on the lender.

Are interest rates on private student loans higher than those of federal student loans? It depends.

With private student loans, the credit history of you or your co-signer will likely be a determining factor in what interest rate you get on your loan. If you or your co-signer have an exceptional credit score and history, your interest rate could be lower. If, for instance, the lender is offering a fixed rate, your fixed interest rate could be lower than the current federal student loan rate.

Time to pull out that pen and paper or fancy spreadsheet and take a few notes. Which loans have you determined you’re eligible for and what are the interest rates on those loans? Are the interest rates fixed or variable? Make a list, note the items above, and prepare to add a few more items of comparison in our next steps.

anchor

3. Repayment Options

After considering the interest rates on the private student loan offers, it’s important to look at the loan repayment options. This may involve reading a bit of fine print!

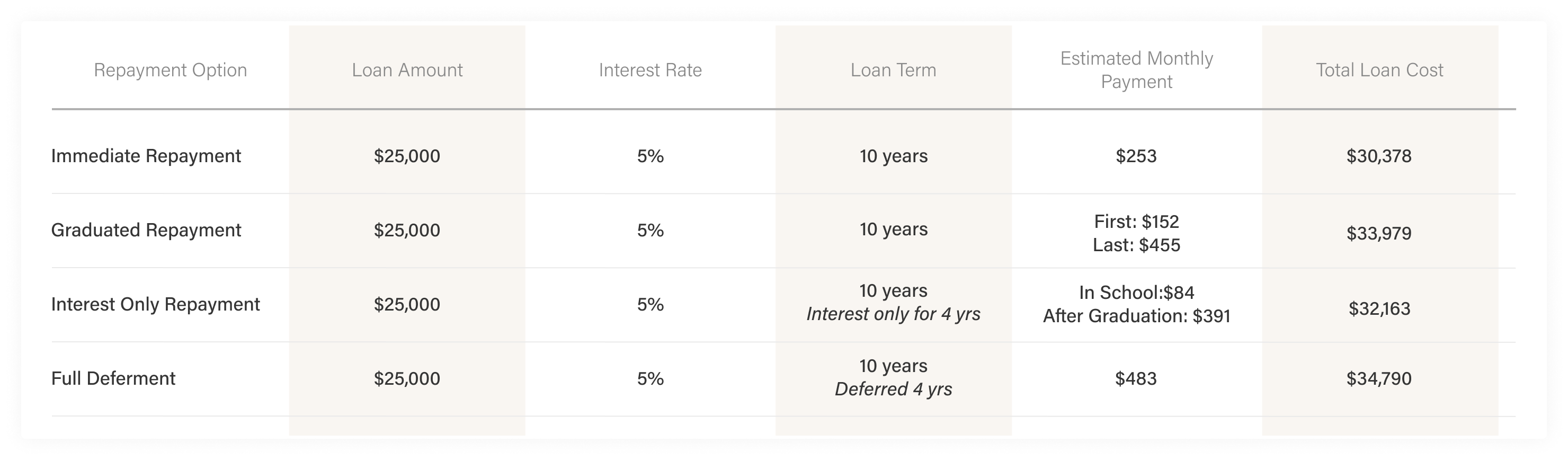

Private student loan providers are generally less flexible when it comes to loan repayment options. Keep in mind that repayment options for each private student loan provider can vary. Below are the four most common repayment options for private student loans.

Immediate Repayment

With immediate repayment, you start paying both the principal and interest payments immediately once the loan is paid to you or your school. This type of repayment plan will allow you to pay off your student loan the fastest.

Graduated Repayment

Graduated repayment plans allow you to increase the amount of your monthly payment towards your loan over time. Graduated repayment plans serve as a nice option for those who can’t afford or don’t wish to make higher payments immediately, but want to work towards paying more to their outstanding balance over time.

Interest Only Repayment

This type of repayment plan allows you to only pay the interest on the loan while you’re in school. Once you’ve graduated, you will then start paying both the principal and the interest. While this option isn’t the quickest, it’s a good option for students who can’t make full payments while in school, but who still want to start the process of paying down the loan.

Some loan providers may also provide a partial interest repayment option. This type of repayment option allows students to pay a fixed monthly amount which would cover only a portion of the monthly interest payment. Remember that if you’re only paying a portion of the interest, the rest of the interest owed is added to your principal balance, meaning your unpaid loan balance is still growing. You will likely end up owing more principal than you initially borrowed once it’s time to make full payments after college.

If you have the option to choose between interest only or partial interest repayment options, and you have the means to pay the full interest amount each month, consider choosing the interest only plan. By paying off the interest amount in full each month, you generally won’t owe more than you borrowed once it’s time to start making full payments after college.

Full Deferment

A repayment plan where a student isn’t responsible for the interest or the principal payments while in college is considered full deferment. This plan allows you to defer, or delay, all payments until after you’ve graduated. If offered, consider this option if you do not have the means to pay either the principal or the interest while in school.

As no payments will be made on the loan balance while you’re in school, you will likely owe more than you initially borrowed once it’s time to start making those full payments. It’s also important to read the fine print here as some lenders may charge a fee for allowing full deferment.

To see what repayment on the same loan might look like with each of the different repayment plans, see the chart below.

Now that you have a good understanding of the most common types of repayment options, time to read through your loan agreements and make note of the repayment options offered by each of the lenders. And don’t forget to take note of the loan term! Generally, most loan terms are for 10 years, but this will have an impact on your monthly payment and may be a deciding factor in which loan you ultimately choose.

anchor

4. Borrower Benefits

Don’t forget to consider customer service and borrower benefits!

It’s important to remember that student loans can sometimes be frustrating. You want to make sure your loan provider has a customer service program that works for you and your needs. Explore the loan provider’s website and reach out to customer service with any questions you have. Make sure you’re getting what you need from the customer service experience because should the time come when you have questions or encounter difficulties, you will want to speak with someone that can help. You can check out reviews of the lender on the Better Business Bureau and other review platforms to get more insight into the reliability of the customer service teams as well.

Additionally, some private student loan lenders may offer a discount or other benefits for customers that set up automatic payments. Be sure to ask about these types of extra benefits so that you can get the most from your loan provider!

anchor

How do I get started?

Now that we’ve covered what to look for when shopping for a loan, let’s take a look at how to get started with the application process.

Get organized

Gather all of the important information (for both you and your co-signer, if applicable) to make applying for the loan simple. Generally, you’ll need the following personal information:

- social security numbers

- addresses

- birthdates

- employment and income information (pay stub copies)

- most recent tax returns

- any mortgage or asset details

###

You’ll also need some information about your school:

- the school’s name

- address of the school

- how much it will cost to attend

- how much you will need to take out in a loan

- when you expect to graduate

Check your school’s website

If you’re unsure of where to go to get started when looking for a private student loan provider, check out your school’s website. Generally, there will be a specific section of the website dedicated to financial aid. There you’ll find various resources and recommendations about starting the financial aid process. Your school’s website is a great resource when navigating the financial aid process - don’t go it alone!

Start early

Finally, as with most things in life, don’t wait until the last minute to apply for a private student loan. You never know what kinds of road bumps you might meet in the process, and its better to get those applications filed sooner rather than later. Make sure to have your applications filed no later than 60 days before the start of the school year.