The little financial habits you cultivate can impact when and how you reach your financial goals. In your 30s, it’s not too late to start evaluating your weekly and monthly financial habits to identify areas of improvement. Even the smallest changes can make an impact on your path to financial freedom. Below are seven of our favorite financial habits to help people in their 30s.

anchor

1. Create a “want” list 📝

Looking for a simple way to resist impulse purchasing? Create a “want” list. Before handing over your money for an item that isn’t a need, write the item on a list. Revisit your list every few weeks to see if the items are still “wants.”

anchor

2. Check your balance 📱

It only takes a few minutes to check your account from your bank’s mobile app or online account center. These few minutes can potentially save you money in the long run. When reviewing your account(s) check the accuracy of your recent transactions and your account balances. These habits keep your money secure and may also help you avoid account (e.g. overdraft) fees.

- Porte makes Checking Your Balance easy: By enabling notifications in the Porte app you can receive notifications about transactions, monthly statements, and overdrafts.¹ You can also set alerts for when your balance goes below a certain number.

anchor

3. Change one small thing 1️⃣

Commit to making one minor adjustment to your weekly routine each week. You can start with brewing your favorite morning beverage at home, learning how to cook your favorite takeout dish, or by riding your bike instead of driving. At the end of each month take note of how these small changes impacted your monthly budget.

anchor

4. Donate 🕊️

Consider setting aside money each week to contribute to a cause you are passionate about. Even donating $5 goes a long way for charities and nonprofits. Want to give back in other ways? Check out our Giving Tuesday blog post for ideas and resources to help you give back to your community.

- Porte makes supporting a charity easy: With Porte’s #DoorToChange³ program, your spending habits can automatically spread goodness year-round. In the app select Support a cause that matters to you from the dashboard. From there, select a partner charity to receive donations when you use your Porte card. These donations don’t cost you anything and support great causes.

anchor

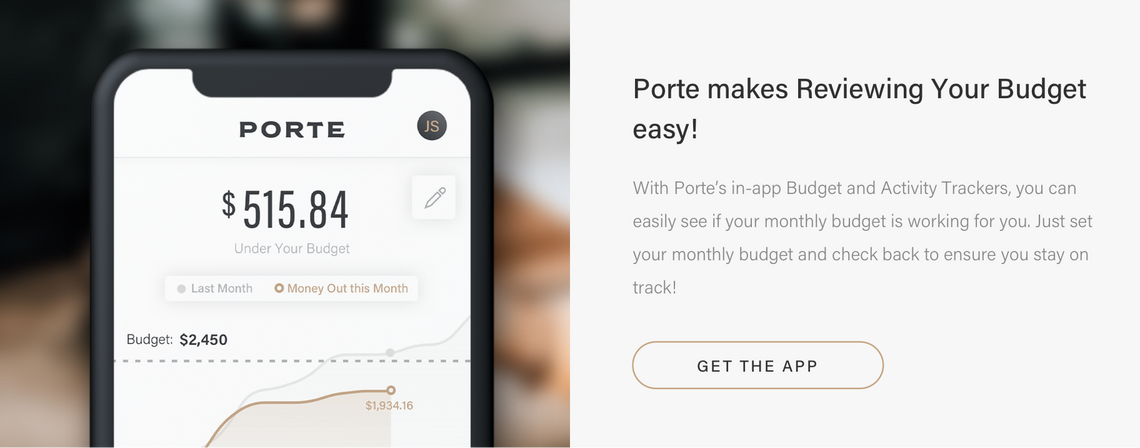

5. Review your budget 🧐

By reviewing your budget monthly you’ll not only be able to see if you’re sticking with your budget, but it also creates an opportunity for you to evaluate your budget. Is your budget realistic? Has your monthly income changed? Answer these types of questions and you’ll be able to see what changes you can make to your budget to help you reach your financial goals. Not sure where to start? Read our Beginners Guide to Budgeting Like a Boss.

anchor

6. Autopay your bills 💳

If you’re able to, set your bills on autopay. Not only is it convenient, but it will also help you make payments on time (goodbye, late fees!). Sometimes companies will even offer incentives if you enroll in autopay.

anchor

7. Go on a “Money Date” 💵

With your partner, or a friend, schedule time each month to check in on your financial goals. Not only will this help keep you accountable, but it’s also a great time to celebrate your achievements, make new goals, adjust your goals, or brainstorm solutions to challenges.

anchor

The bottom line…

Identifying changes to make to your weekly and monthly financial habits is an iterative process. By making small, consistent changes over time, you’ll be able to keep making progress towards reaching your financial goals.