Choose from the app stores below.

Overdraft Service with Porte®

Overdraft Service is your choice

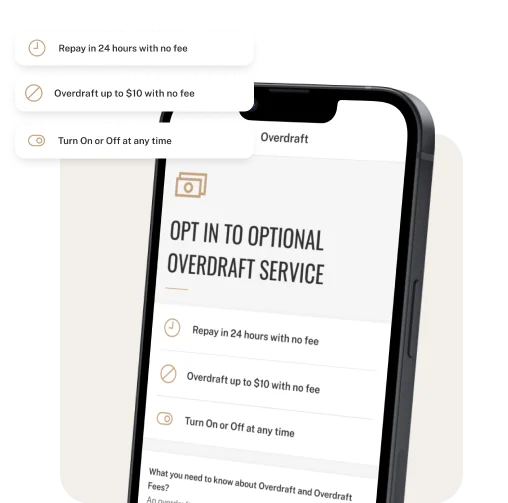

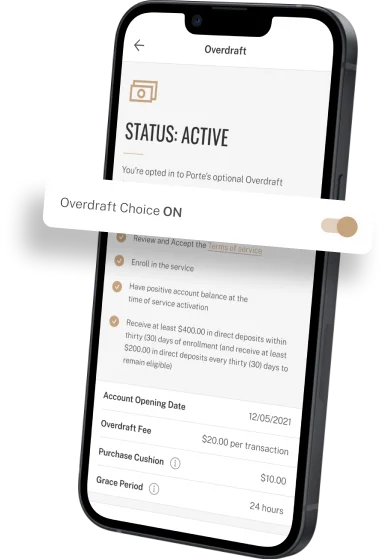

With Porte, you have full control over your Overdraft Service. Use Overdraft Choice2 to turn it on when you need it, and off when you don’t. When Overdraft Choice is turned on, you’ll be protected from overdrawing your account.

Overdraft Fee

Us vs. Them

$20

$20

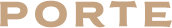

How to use Porte’s Optional Overdraft Service

Opt-in to Overdraft Service

Turn on Overdraft Choice2 When You Need It

What else you can do to help prevent and manage overdrafts

Know your current balance

Use the Porte mobile banking app to keep track of your available funds so that you don’t overspend.

Set up Account Alerts

Get a push notification when your account balance is getting low or anytime your debit card is used.

Porte is a mobile finance app, not a bank. Banking services provided by Pathward®, National Association, Member FDIC.

No results for “”

Please try another search term.

Does Overdrafting Affect your Credit Score

Questions?

What is an overdraft fee?

An overdraft fee is a fee that a bank or credit union charges you when a purchase or other transaction exceeds the available balance in your spending account. Overdraft fees can be charged on in-store purchases, online shopping, bill payments, and cash withdrawals. Learn more about overdraft fees on our blog.

What is Porte’s optional Overdraft Service?

The Optional Overdraft Service1 is Porte’s overdraft service feature. Once you enroll and meet the eligibility requirements, you will be charged $20.00 for each one-time debit card transaction that overdraws your account by more than $10.00, up to a maximum of five (5) fees per calendar month. To avoid the overdraft fees, you have twenty-four (24) hours from the time of the first transaction that creates the overdraft to bring your negative account balance back to a zero ($0.00) or a positive balance.

What is Overdraft Choice?

Overdraft Choice2 is the feature that allows you to turn the optional Overdraft Service on and off. When Overdraft Choice is turned on, your purchases will be declined if there are insufficient funds in your account to cover the purchase. When Overdraft Choice is turned off, the optional Overdraft Service is enabled and you can overdraft by up to $10 without having to pay any fees.

You must be enrolled and eligible for the Overdraft Service to use Overdraft Choice within the Porte mobile banking app.3

Porte is a mobile finance app, not a bank. Banking services provided by Pathward, National Association, Member FDIC.

How do I get the optional Overdraft Service with Porte?

You may enroll in the Overdraft Service under Account Info in the user profile. You must receive Direct Deposits totaling at least $400.00 to your Account within thirty-five (35) days of your enrollment in the Service (Direct Deposits received prior to enrollment count towards this total). You must have a positive Available Balance in your Account at the time we activate the Service on your Account. Once you have met all eligibility requirements, your participation in the Service will be activated within twenty-four (24) hours. Once the Service is activated on your Account, you MUST continue to receive Direct Deposits totaling at least $200.00 to your Account every thirty (30) days or we will deactivate your participation in the Service.

Do I have to pay for Overdraft Service?

There is no fee to enroll in the optional Overdraft Service. However, you may incur fees when you use the service. Once you overdraft, if you bring your account back to a positive balance within 24 hours, no fee is charged. After 24 hours, you will be charged a $20 fee per transaction that overdrafts your account by more than $10.

How long do I have to pay back the amount I overdraft without a fee?

You have 24 hours from the time your transaction posts to your account to pay back an overdraft transaction that settles and creates a negative balance greater than $10 before a fee is assessed. Let’s say that you overdraft your account by more than $10 at 2:00 p.m. on Thursday, then you have until 2:00 p.m. on Friday to add the funds into your account to avoid a fee.

Here’s how to bring your account back to zero or more to avoid paying an overdraft fee:

- Transfer money from your Savings Account to your Spending Account.

- Add cash in-person at an ACE Cash Express location for no fee when you meet Direct Deposit requirements.6

- Add cash at a Netspend network location.7

- Receive funds through Direct Deposit, use Mobile Check Capture to add funds to your account.8

- Transfer money from a debit card.9

- Transfer money from another bank account.10

What type of Overdraft transactions can I make?

At our discretion, the Overdraft Service may cover debit purchases and ATM withdrawals. The Overdraft Service will not cover ACH debit transactions or reoccurring debit transactions.