The referral link you used is no longer valid. You can try another referral link or download Porte in the App Store or Google Play.

Porte is a full-service mobile banking app with in-person support

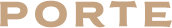

Get paid early

Get paid up to 2 days faster1

with Direct Deposit

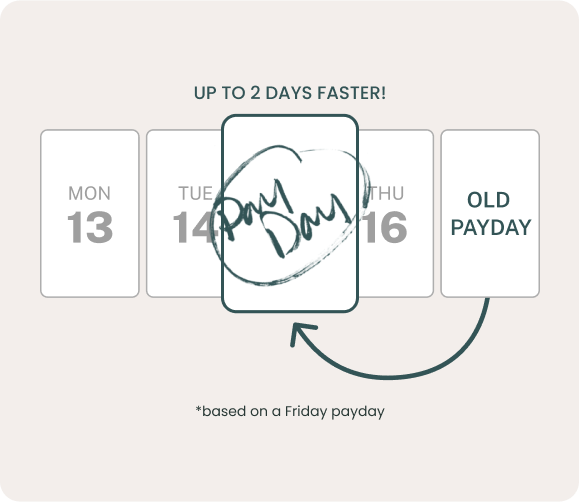

Charitable giving

You spend, and we give to charity2

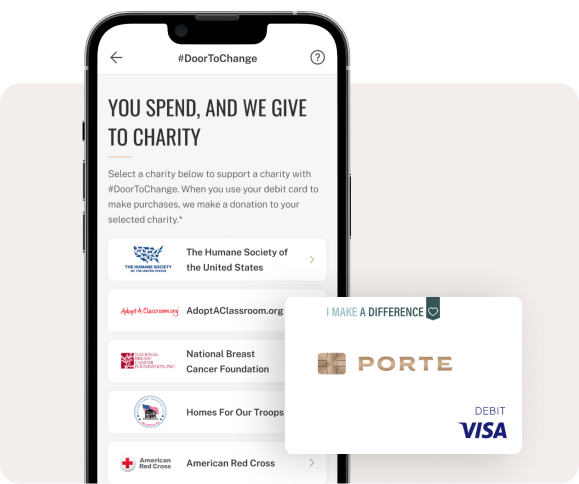

Earn cashback reward offers when you spend at select retailers nationwide3

Porte Perks participants change. These are accurate as of 1/1/2024.

Savings

Enjoy a bonus savings rate that’s 9x more than the National Average6

optional Overdraft SERVICE

Overdraft Service when you need it9