Choose from the app stores below.

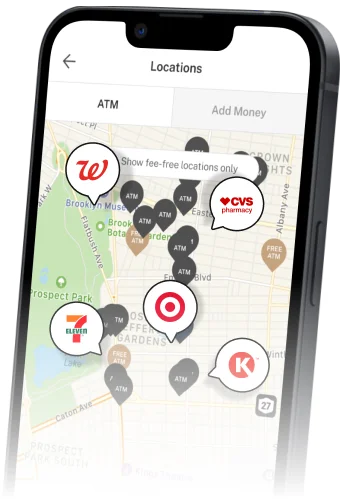

Fee-free ATMs near me1

You can locate fee-free ATMs using the ATM finder in the Porte app.3

One of the largest fee-free ATM networks

Porte customers enjoy over 40,000 fee-free ATMs through the MoneyPass® network.1 Check the Porte app3 for the most up to date list of fee-free ATMs, plus find locations to add cash to your Porte account.4

Grab cash on the go, fee-free

With access to one of the largest fee-free ATM networks1, MoneyPass®, there is no better time to join Porte.

Add cash with no fee at ACE Cash Express5

Visit one of more than 800 ACE Cash Express store locations across the U.S. and get access to in-person account services. When you have Direct Deposit, you can add cash with no fee5 and make fee-free cash withdrawals of up to $500 per day2 from your Porte account at ACE!

The mobile banking app with in-person service across the country

Do it all at ACE Cash Express:

with Direct Deposit

up to $500 per day with Direct Deposit

whether new, lost, or stolen, get a debit card same-day6

Porte is a mobile finance app, not a bank. Banking services provided by Pathward, National Association, Member FDIC.

FAQs

What ATMs have no fees with Porte?

Porte offers a network of 40,000+ fee-free, in-network MoneyPass® ATMs.1 These ATMs can be found at nearby stores, including CVS Pharmacy®, Walgreens®, 7-Eleven®, and more. You can also take advantage of no-fee cash withdrawals up to $500 per day at ACE Cash Express stores with Direct Deposit.2

Fees may apply when using out-of-network ATMs, including Allpoint or Visa Plus Alliance ATMs. To find a surcharge-free ATM near you, download the Porte mobile app3 and tap “Locations” from the dashboard. You can also search using our ATM locator.